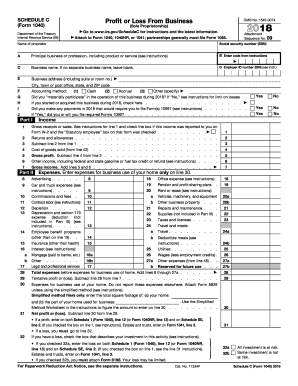

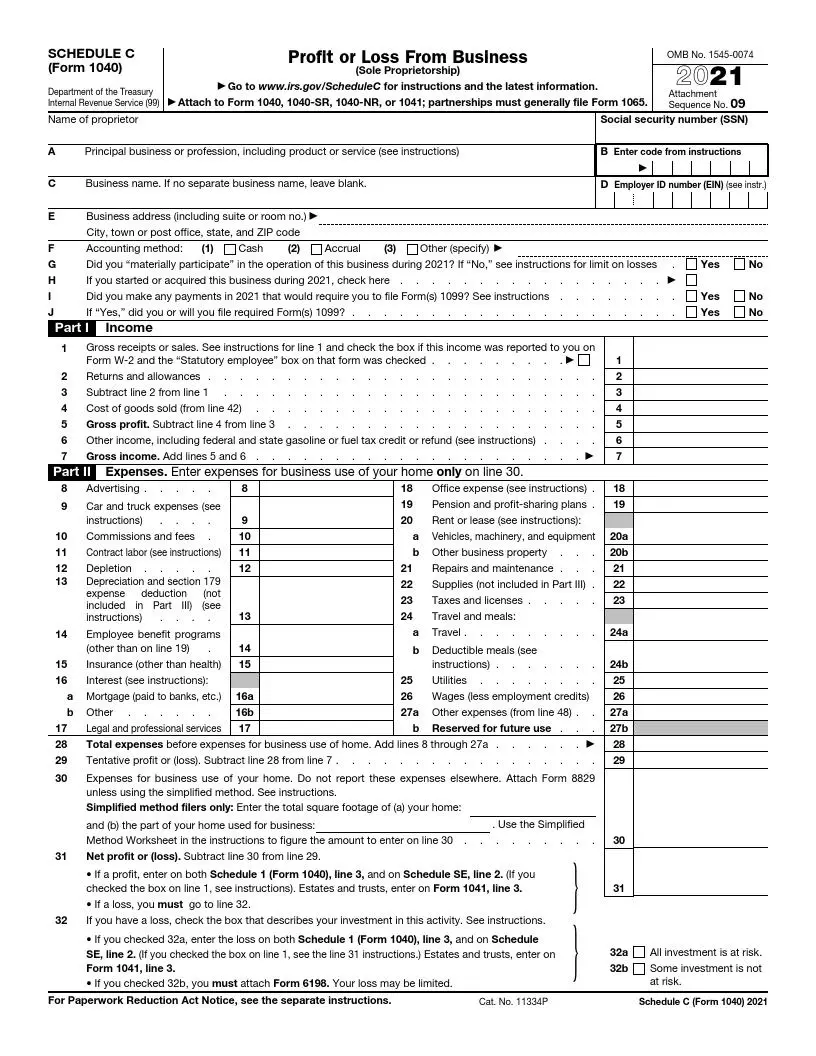

schedule c tax form 2021

1545-0074 2021 Sole Proprietorship to. What is a Schedule C Tax Form and how do I know if I need it.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Ad Easily File Tax Forms And Find Every Write Off With TurboTax Self-Employed.

. You may also need Form 4562 to claim depreciation or Form 8829 to. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Access IRS Tax Forms.

We last updated Federal 1040 Schedule C in January 2022 from the Federal Internal Revenue Service. View 2021-Business-Tax-Returnspdf from ACCT TAXATION at Drexel University. Internal Revenue Service 2021 Instructions for Schedule CProfit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business you operated or a.

Complete Edit or Print Tax Forms Instantly. This form is for income earned in tax year 2021 with tax returns due in April 2022We. Schedule C Form 1116 is used to identify current year foreign tax redeterminations in each separate category the years to which they relate and.

Fill Out Professional Templates In Your Browser. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses. Moving Expense Deduction For taxable years beginning on or after January 1 2021 taxpayers should file California form FTB 3913 Moving Expense Deduction to claim.

Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Profit or Loss From Business SCHEDULE C Form 1040 a Go OMB No. This form is used to report income and expenses and ultimately helps to undermine whether a business has a profit or loss for the.

Ad Answer Simple Questions And Fill Out Your Form Accurately. Ad Easily File Tax Forms And Find Every Write Off With TurboTax Self-Employed. Create Your Free Account.

Save And Print - 100 Free. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Complete Edit or Print Tax Forms Instantly.

Its part of the individual tax return IRS form 1040. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form. Inst 1040 Schedule C Instructions for Schedule C Form 1040 or Form 1040-SR Profit or Loss From Business Sole Proprietorship 2021.

Income Tax and Benefit Package for Non-Residents and Deemed Residents of Canada for 2021 5013-SC Schedule C - Electing Under Section 217 of the Income Tax Act for. Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor.

Purpose of Schedule. Ad Access IRS Tax Forms.

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Tax Forms Irs Forms

What Do The Expense Entries On The Schedule C Mean Support

Irs Schedule C 1040 Form Pdffiller

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Tax Forms Irs Forms

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Credit Card Statement Tax Forms

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

What Is Schedule C Tax Form Form 1040

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Schedule C Form 1040 Irs Taxes Tax Return Accounting And Finance

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Schedule C Form 1040 Irs Taxes Tax Return Accounting And Finance

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

What Do The Expense Entries On The Schedule C Mean Support

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Irs Schedule C 1040 Form Pdffiller

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)